Tracking business gas card purchases can be an overwhelming and labor intensive task. First you have to collect the fuel receipts from your drivers which is easier said than done because drivers forget receipts or gas pumps will run out of receipt paper. Then you have to enter all the receipts into an Excel spreadsheet.

Fleet fuel cards when properly used can make business gas card tracking easy. You will no longer need to collect and enter fuel receipts which eliminate 95% of your fuel relate work. Let’s start with how fleet gas card tracking works to help you under stand how you can track your fuel card purchases with minimal effort.

How Business Gas Card Tracking Works

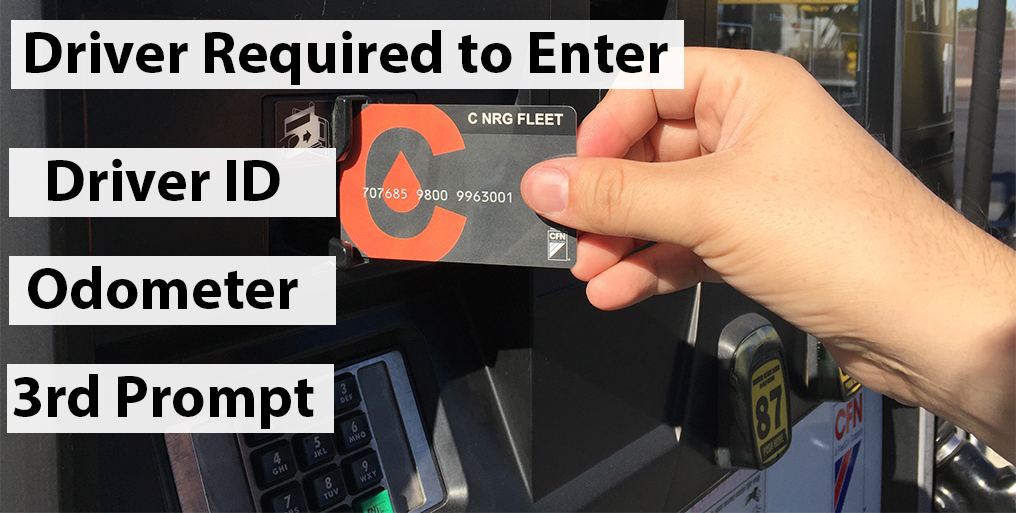

The first step is data collection at the point of purchase. When you use a fuel card at the pump the driver will have to enter the pin number, odometer, and sometimes a custom third prompt (job number, vehicle number, etc..). Here’s how this data will collect so much more information than your standard credit card.

- Driver ID (pin number) – will collect a driver profile which is all the driver information and controls related to the driver

- Odometer – estimates the miles per gallon which helps you verify that a purchase needs to be made. If a driver puts in a full tank and only drives 200 miles and uses another full tank when they should get 400 miles per tank, where is that fuel going? Driver misuse? Vehicle mechanical issues?

- Custom third prompt- this can help allocate fuel cost for a job number, truck number, etc.. This gives you another relevant data point to reference based of your businesses needs.

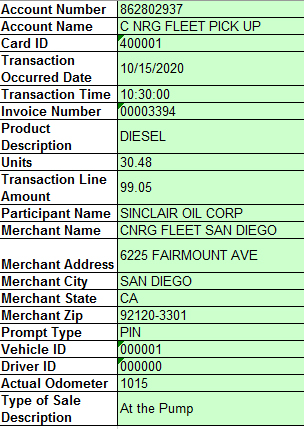

After this data is collected the pump will authorize the transactions and the driver will begin fueling. After the transaction the following data will post.

- Card number

- Vehicle ID

- Driver name

- Quantity

- Product ID

- Product description

- Time

- Date

- Location number

- Address

Transaction Example

Use The Collected Fuel Card Data For Accounting & Fleet Management

Now that the fuel card has collected the data at the pump you can run the following reports to help track down transactions, review driver purchase behavior, and create reports for your accounting team or government agencies (IFTA Reporting).

- Transaction detail report – complete list of transactions by driver, vehicle, date, etc.

- Exemption report – identifies transactions that are outside of the normal settings. I.E. a diesel vehicle purchasing has

- IFTA report – summarizes fuel purchase by state

- Authorization report – troubleshoots why a fuel card is not working at the pump

- Card inventory report – shows all active fuel cards in your account with their associated controls

These reports are not only going to help you with submitting reports but they will also help you track down driver fuel card misuse and theft. You’ll start to see patterns for certain drivers and recognize when something is off.

Use Business Gas Card Tracking Data To Refine Card Controls

Fuel card controls are what help prevent a driver from misusing a fuel card. There are controls such as transactions per day, gallons per transaction, gallons per day, gallons per week, time of day, day of week, etc. that will narrow down when and how much fuel a driver can buy.

When you evaluate the data you can examine driver behavior to get a better idea of how many transactions a driver/vehicle needs per day so you can adjust your fuel card controls according.